2012 Annual Sustainability Report

Performance

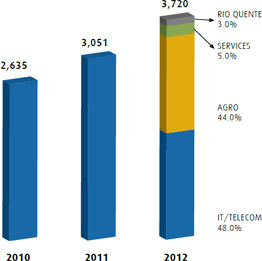

Grupo Algar's consolidated net revenues amounted to R$3,719.9 million at the close of 2012, up 21.9% vs. the amount recorded at the close of 2011, when they came to R$3,051.1 million.

Economic Environment

The first half of 2012 was marked by the uncertainty brought about by the world economy as a result of the European crisis. Concerns about a breakup of the bloc affected the world's economic performance throughout the year and remains one of the main risk factors in 2013. The sluggish rebound in the U.S. and the slowdown in China also contributed to the deterioration of the economic projections.

The Brazilian economy, as well as all other emerging economies, was affected by this situation. The monetary authority and the Government took anticyclical measures to check the downturn in industrial activity. Although an upward trend started in the second half of the year, the 2012 growth rate was disappointing. The Brazilian GDP grew by 0.9% in 2012, far below the 3% expansion projected in the previous year. An even greater reason for concern was the perceived drop in investments, essential to promote growth and mitigate the infrastructure bottlenecks. The main stimulus measures taken by the government included a temporary tax break for certain industries and a steady reduction in the basic interest rate, which fell from 11.5% at the close of 2011 to 7.25% at the close of 2012.

Nevertheless, it was not a lost year. The labor market remains one of the pillars of the Brazilian economy and helps maintain household spending. According to IBGE (Instituto Brasileiro de Geografia e Estatística, or Brazilian Institute of Geography and Statistics), the unemployment rate stood at 4.6% at the close of 2012–the lowest in the historical series–, with an average rate of 5.5% in the year. The average income of the working population rose by 4.1% vs. 2011, when it rose by 2.7%.

It is in times of uncertainty like these that Algar's business diversification strategy proves wise. The Group operates in different industries, many of which complement one another, which helps it maintain a solid, safe presence nationwide. However, the telecom and agribusiness segments stand out, accounting for 48.71% and 43.9% of net revenues respectively.

The telecom industry was once more benefited by the booming demand for mobile phone services (in 3G lines with access to mobile broadband) and for pay TV services, which increased by 27%, the sharpest growth in the industry. In turn, Algar Telecom was able to seize the opportunity and increased its market share in its concession and authorization areas.

Concerning agribusiness, there was a drought in South America in early 2012, which had a direct impact on prices. Grain prices reached all-time highs; as a result, revenues increased by 15.8% even though exports flattened out year-overyear. With favorable climatic conditions in early 2013, the outlook remains positive for the industry.

Economic and Financial Performance

Net Revenue

(R$ million)

Net Operating Revenues

Grupo Algar's consolidated net revenues amounted to R$3,719.9 million at the close of 2012, up 21.9% vs. the amount recorded at the close of 2011, when they came to R$3,051.1 million. The operational performance of all the Company's different businesses contributed to this result. The agribusiness segment, which accounted for 43.9% of net revenues, recorded a 44.3% revenue increase due to higher soybean prices in the international market. Revenues from the IT/ telecom segment increased by 7.7% and accounted for R$129 million of total net revenues. This rise resulted from the increases in BPO and IT operations, as well as in broadband and data services, in the concession area.

Cost of Goods Sold and Services Provided

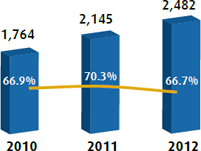

(R$ million)

Cost of Goods Sold and Services Provided

In 2012, Grupo Algar reported R$2,481.9 operating costs, up 15.7% from the R$2,145.4 million recorded in 2011. The cost-to-net-revenue ratio stood at 70.3% in 2011 against 66.7% in 2012, which shows that Algar has succeeded in using resources more efficiently.

The greatest increase was in raw material and input costs, which came to R$1,221.8 million in 2012 vs. R$881.8 million in 2011, a 37.5%.

Gross Profit and Gross Margin

After the costs described above, the Group recorded gross profit of R$1,238.0 million, up 36.7% against the R$905.7 million reported in 2011. Gross margin stood at 33.3% at the close of 2012, up 3.6 p.p. from the 29.7% recorded in 2011. Gross margin increased because net revenues rose proportionally more than costs.

Operating Expenses

| (R$ million) | 2012 | 2011 | 2012 x 2011 |

|---|---|---|---|

| Selling Expenses | 373.7 | 345.6 | 8.1% |

| General & Administrative (G&A) Expenses | 244.9 | 197.6 | 23.9% |

| Total Operating Expenses | 618.6 | 543.1 | 13.9% |

Operating expenses totaled R$618.6 million in 2012, rising by 13.9% in relation to 2011, when they came to R$543.1 million. Selling expenses rose by 8.1%, from R$345.6 million in 2011 to R$373.7 million in 2012, less than the increase in net revenues.

General and administrative expenses climbed by 23.9%, from R$197.6 million in 2011 to R$244.9 million in 2012. These higher expenses are connected with the expansion in operations, mainly in the IT/telecom and agribusiness segments. Personnel expenses shot up by 20.1%, explained largely by new hirings for Projeto Minas (Minas Project) and client services in the IT/telecom segment.

EBITDA and EBITDA Margin

EBITDA and EBITDA Margin

(R$ and %)

In 2012, operating cash generation as measured by EBITDA came to R$534.x million, 4.3% higher than the R$512.x reported in 2011. On the same basis for comparison, EBITDA margin fell by 2.4 p.p. to 14.4% at the close of 2012.

All the Company's business segments contributed to EBITDA. However, IT/telecom outperformed all others and increased by 10.2% in relation to 2011, followed by Tourism at 8.3%. This expansion was made possible by Algar Telecom's performance in the corporate market, its main business focus, mainly in connection with broadband, data, BPO and IT products. On the other hand, the agribusiness segment recorded a 35.2% drop in the same period, explained by higher costs in variable inputs (components of industrial costs), freight costs in domestic sales and fobbing costs in exports (port tariffs). They were also negatively impacted by overhead expenses due to the organizational restructuring.

Financial Result

| 2012 | 2011 | 2012 x 2011 | |

|---|---|---|---|

| Financial Income | 500,243 | 358,647 | 39.5% |

| Financial Expenses | -874,934 | -488,181 | 79.2% |

| Net Financial Income (Expense) | -374,.691 | -129,.534 | 189.3% |

The Group reported a net financial loss of R$374.7 million vs. a R$129.5 million loss in 2011. The fact that the agribusiness segment had a financial loss of R$282 million largely explains the Group's higher loss in 2012. That change was almost entirely due to: i) the agribusiness segment's increased need for working capital in connection with the margin at the Chicago Mercantile Exchange, which at a certain point exceeded US$200 million whereas soybean futures reached higher prices and ii) the mark-to-market of financial instruments and inventories, which led to R$120 million losses in derivatives.

* Market value of financial instruments and inventories, net:

- Mark-to-market of inventories: a gain of R$102 million in 2012 vs. R$54 million in 2011.

- Hedging operations: a R$215 million loss in 2012 vs. a R$117 million loss in 2011.

In 2012, Agro recorded an increase in contracts and higher average soybean prices: R$72.00 in 2012 and R$47.71 in 2011.

Net Income and Net Margin

(em R$ and %)

Net Income

The bottom line of Grupo Algar's 2012 income statement totaled R$170.9 million, a 14.7% drop over the R$200.3 million recorded in 2011. The margin over net operating revenues was 4.6% in 2012, down 2.0 p.p. year-over-year. Higher revenues and profitability partly offset the major impact of the financial loss on net income.

Investments (CAPEX)

In 2012, Grupo Algar invested R$440 million in its businesses vs. R$489 million in 2011.

Nearly 70% of this amount was invested in expanding operations in Algar Telecom's authorization area through Projeto Minas.

Debt

| Loans, supplier financing and debentures |

dec/11 | dec/12 | Variation of the total | |||||

|---|---|---|---|---|---|---|---|---|

| Short term | Long term | total | Short term | Long term | total | |||

| Holding | 827 | 898 | 1726 | 957 | 1126 | 2083 | 358 | 21% |

| TELECOM | 185 | 605 | 790 | 106 | 815 | 921 | 131 | 17% |

| AGRO | 627 | 215 | 842 | 824 | 229 | 1053 | 211 | 25% |

| RIO QUENTE (50%) | 5 | 27 | 32 | 6 | 26 | 32 | 0 | 1% |

| SERVICES | 6 | 22 | 28 | 14 | 32 | 46 | 18 | 62% |

| Algar | 3 | 30 | 32 | 7 | 24 | 31 | -1 | -4% |

Gross Debt

(R$ million)

On December 31, 2012, the Company had a consolidated gross debt of R$2,083 million, a 20.7% rise year-over-year. Cash and cash equivalents amounted to R$597 million, and net debt to R$1,486 million.

The short-term debt totaled R$957 million, up 15.7% from the R$827 million reported at the close of 2011. Long-term debt increased 25.4%, from R$898 million in 2011 to R$1,126 million in 2012. The short-term debt ratio in 2010 versus 2012 rose 0.2 p.p. whereas the change the long-term ratio fell in the same proportion.

Value Added

In 2012, Grupo Algar's operations generated a net value added of R$2,030.1 million (vs. R$1,666.1 million in 2011), which corresponds to 54.6% of net revenues. It was distributed as follows:

| Direct economic value generated | |||

|---|---|---|---|

| 2010 | 2011 | 2012 | |

| a) Net revenue from sales | 2,600,000,.000.00 | 3,100,000,000.00 | 3,719,898.00 |

| Economic value distributed | |||

| b) Operating costs | 1,800,000,000.00 | 2,100,000,000.00 | 2,481,850.00 |

| c) Salaries and employee benefits (1) | 505,000,000.00 | 624,000,000.00 | 753,529.00 |

| d) Payments for capital purveyors | 185,000,000.00 | 200,000,000.00 | 449,478.00 |

| e) Payments to government | 611,000,000.00 | 646,000,000.00 | 712,105.00 |

| e) Investment in the community | |||

| Economic value retained | |||

| 5,701,000,000.00 | 6,670,000,000.00 | 8,116,860.00 | |

(1) Includes total wages, social charges and employee benefits.

Significant financial assistance received from government

Grupo Algar receives tax incentives from the three spheres of government: local (ISS and IPTU – Culture Incentive Law of Uberlândia), state (State Law of Incentive to Culture) and federal (Fund for Children and Adolescents (FIA), Rouanet Law – Culture Incentive Law).

| Value in R$ | ||||

|---|---|---|---|---|

| DESCRIPTION | 2010 | 2011 | 2012 | Comments |

| Municipal Law of Incentive to Culture | 151,000.00 | 70,000.00 | 109,004.00 | ISS/IPTU |

| State Law of Incentive to Culture (MG and SP) | 2,219,542.00 | 2,417,574.00 | 2,812,771.00 | ICMS |

| Federal Law of Incentive to Culture | 804,330.00 | 801,270.00 | 833,633.98 | Rouanet Law |

| Federal Law of Incentive to Sports | 201,167.00 | 207,848.00 | 208,375.00 | Sports Law |

| Fund for Children and Youth | 202,834.00 | 207,732.00 | 178,280.00 | |

Examples: Tax incentives / credits, subsidies, Subventions for investment, research and development and other relevant types of concessions, Awards, Royalty holidays (incentives that delay the payment of royalties); financial assistance from Export Credit Agencies (ECAs); Financial incentives; Other financial benefits received or receivable from any government for any operation.

In 2012, tax incentives amounted to R$4,142,259.38, allocated to the following projects/institutions:

1. Municipal Law of Incentive to Culture – Uberlândia

- A Pessoa Com Deficiência Visual Sob Um Novo Olhar (A New Look on Visually- Impaired People): 23,000.00

- ABBA de Lá e ABA de Cá: 20,000.00

- "O Mágico de Oz" (The Wizard of Oz) Tour: 26,002.00

- Dançarte para Meninos (Dance Art for Boys): 12,002.00

- "Um Violino com Amor" (A Violin with Love) in Nicolau Sulzbeck's performances: 28,000.00

2. Minas Gerais State Law of Incentive to Culture

- Circulação Escutatória Emcantar: 380,825.50

- Emcantar Singing, Drama and Percussion Workshops: 275,000.00

- Minas Gerais State Philharmonic Orchestra–State- and Nationwide Tours: 175,000.00

- Uberlândia Youth Orchestra: 150,000.00

- 3rd Winter Festival of Serra da Canastra: 150,000.00

- 7th Festival of Arts and Culture: 119,250.00

- 8th Nathan Schwartzman String Festival: 148,044.08

- Natal no Campus 2012 (2012 Christmas on Campus): 30,000.00

- Rasgacêro e os Artêros Geraes: 150,000.00

- Recortes da Memória - Histórias de Vida (Memory Cut-Outs–Life Stories): 268,750.00

- Reconhecimento Rondon Pacheco: 247,610.00

- Triângulo das Geraes III: 285,000.00

- Uberlândia de Ontem e Sempre (Uberlândia Now and Forever): 312,500.00

- Franca Basquete.com Project: 120,791.00

3. Federal Law of Incentive to Culture (Rouanet Law)

- Emcantar: Ideias Incontidas – 3rd year: 241,655.00

- Emcantar: Escutatória Tour: 327,125.00

- Cerrado Choir: 264,853.98

4. Federal Law of Incentive to Sports (Sports Law)

- Instituto Sports (Sports Institute): 180,000.00

- Minas Tênis Clube (Minas Tennis Club): 28,375,00

5. Fund for Children and Youth (FIA)

- Uberaba City Commission for the Rights of Children and Youth: 13,430.00

- Itajubá City Commission for the Rights of Children and Youth: 15,500.00

- Itumbiara City Commission for the Rights of Children and Youth: 15,000.00

- Patos de Minas City Commission for the Rights of Children and Youth: 13,430.00

- Pará de Minas City Commission for the Rights of Children and Youth: 13,430.00

- Franca City Commission for the Rights of Children and Youth: 13,430.00

- Ituiutaba City Commission for the Rights of Children and Youth: 16,000.00

- Uberlândia City Commission for the Rights of Children and Youth: 16,000.00

- Santa Luzia Municipal Assistance Fund: 13,430.00

- Municipal Fund for Children and Adolescents / Jogo Limpo II: 8,100.00

- Municipal Fund for Children and Adolescents / ApriMorar: 8,100.00

- AACD São Paulo: 13,430.00

- AACD Uberlândia: 16,100.00

- AACD Porto Alegre: 2,900.00

In 2012, Grupo Algar also received R$1,321,239.69 from tax incentives to technological innovation, earmarked to Algar Telecom's and Algar Tecnologia's R&D projects. These amounts were R$1,064,103 and R$777,408 respectively in 2011 and 2010.

In 2011, the Brazilian Federal Government launched the Brasil Maior (Greater Brazil) Plan, designed to strengthen the Brazilian manufacturing industry against competition from imported goods. The purpose is to promote the sustainable growth of the Brazilian economy despite the deepening international crisis and market downturns. The Plan comprises tax and credit measures, trade financing, incentives to the IT and communications industries.

The IT, call center and hotel businesses of Grupo Algar received incentives, such as lower payroll taxes, with the replacement of dues paid by employers (20% of INSS) by a tax-like contribution of 2.0% of gross revenues. This incentive led to a R$20,579,522.55 drop in Grupo Algar's tax expenses.