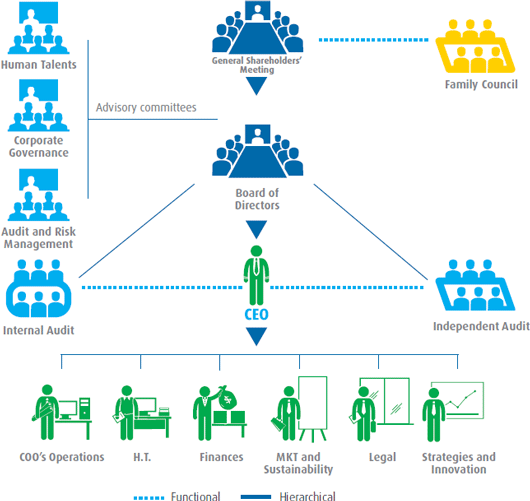

Family Council

The Family Council addresses issues related to shareholders’ common interests by establishing clear rules to manage the Group in a professional, effective and transparent manner. Family governance follows the Garcia Family Constitution, which sets rules for the relationship of the current and future generations in their three key roles: as Family Members, as Owners and as Group Employees. The Family Council validates and enforces the Family Constitution, designs and executes the Educational Program, promotes family integration and protects the shared assets among other responsibilities.

Board of Directors

Elected annually at the Annual General Meeting, the Board of Directors is the decision-making body that sets the Algar Group’s strategic guidelines among other duties. All Board activities and responsibilities, as well as its relationship with the Board of Executive Officers and other corporate bodies, are outlined in our Policies and Procedures, approved by the General Meeting and based on the Brazilian Corporations Act, the Group’s Bylaws and IBCG's (Instituto Brasileiro de Governança Corporativa, or Brazilian Corporate Governance Institute) Code of Best Corporate Governance Practices.

Even though our shares are not traded on stock exchanges, we have voluntarily decided not only to have independent members, but also for them to comprise most of the Board, which has nine members. In December 2014, six Board members were independent–that is, they had no emotional or business ties with the Company or the family that controls it. Independent members bring knowledge and experience from out of the company; in addition, they add great value to the Board by making the decision-making process more objective and rational in matters that may involve conflicts of interest.

This policy of voluntarily separating executive officer and director positions is provided for in the Company's Bylaws, which forbids the same person from holding these both of these positions at a time. Consequently, the Chairman of the Board of Directors and the Chief Executive Officer also have to be different individuals.

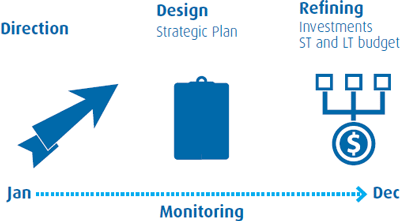

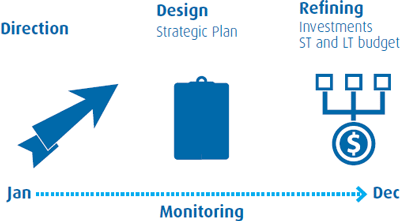

The Board meets six times a year, according to a pre-established topic-based schedule, and at such other times as may be necessary. This annual schedule and the topics addressed follow the Algar Group’s Planning and Control Cycle.

Advisory Committees

Algar’s Board of Directors created three advisory non-decision-making committees: the Audit and Risk Management, Corporate Governance and Human Talents Committees. The committees are formed by independent experts and advisors. All the Committee’s activities and responsibilities, as well as their relationships with the Board of Directors, the Board of Executive Officers and other corporate bodies, are outlined in our Policies and Procedures approved by the Board of Directors and based on the recommendations of IBCG's Code of Best Corporate Governance Practices.

Audit and Risk Management

This Committee is meant to ensure the quality, integrity, transparency and credibility of the Company’s Financial Statements. It also ensures the effectiveness of internal and independent audit processes, and internal controls, as well as compliance with the applicable legislation. Finally, it ensures that corporate and operational risks are managed appropriately. The internal audit department and the independent auditors report to the Audit and Risk Management Committee. Learn more in the Risk Management section. Saiba mais na seção Gestão de Riscos.

Human Talents

This Committee promotes a policy of valuing Human Talents, following the best strategic people management practices, in keeping with the Algar Group’s different business segments. It monitors organizational development, leadership training and development, the compensation policy and the organizational climate.

Corporate Governance

The Corporate Governance Committee monitors the operation and effectiveness of the Algar Group’s corporate governance system. It proposes best practices or adjustments that strengthen the vision of the future and enhance long-term prospects.

Executive Committee

The Executive Committee consists of the Board of Executive Officers and the executives responsible for the Algar companies. It meets every two weeks or as needed to discuss corporate issues and operations, and share experiences.

Board of Executive Officers

Composed of the Chief Executive Officer (CEO), four Vice-Presidents and the General Counsel, the Board of Executive Officers is responsible for controlling operations, leading the Group’s strategic execution and protect the unity of the Algar culture, brand and values. It follows the guidelines of the Board of Directors. It takes into account mainly corporate risks, the promotion of synergy among the Algar companies, leadership training and the establishment of institutional relations. It meets once a week or as needed to discuss and make decisions on strategic corporate issues.

Luiz Alexandre Garcia • CEO

Cícero Domingos Penha • VP-Human Talents

Eliane Garcia Melgaço • VP-Marketing and Sustainability

Marcelo Mafra Bicalho • VP-Finances

Mauri Seiji Ono • VP-Strategy and Innovation

Fernanda Aparecida Santos • General Counsel

Internal and Independent Audit

Both audit teams report directly to the Board of Directors through the Audit and Risk Management Committee. In functional terms, they report to the Group’s holding company to ensure autonomy and independence from operations.

Internal Audit: The Internal Audit team promotes transparent and independent risk assessment, internal controls, compliance with regulations, rules, internal and external policies. It follows an annual plan set jointly with the Board of Directors based on the main business risks. If the team finds any incidents of non-compliance, it prepares and monitors action plans for its recommendations. In 2014, there were 30 audits at Algar companies.

Independent Audit: Independent auditors express an opinion on the Group’s financial statements based on audit conducted in accordance with Brazilian and international standards. In 2014, the Algar Group replaced its independent auditors, in line with the practices it voluntarily adopts but are required from publicly-held companies by CVM (Comissão de Valores Mobiliários, or Brazilian Securities Commission). Ernst & Young Auditores Independentes S.S. are our current independent auditors.

Other Practices

Associates’ Committee

The Associates’ Committee is a multidisciplinary advisory body with members from all companies elected freely by Associates for an indefinite term. The Group promotes interaction and rapport among associates, the Human Talents department and the Board of Executive Officers. It also actively participates in collective bargaining and handles issues related to business continuity.

Governance Portal

The Governance Portal is a restricted-access, exclusive online channel for the members of the Board of Directors. It contains documents and information that they need in their activities.

Executives’ variable compensation connected with EVA® goals

In keeping with its goal of aligning its interests with those of its shareholders, the Algar Group pegged variable compensation in 2014 to the EVA® goals, financial growth and health, thus strengthening the alignment between executives’ and shareholders’ interest. (learn more in Career Building – Variable Compensation).

Code of Conduct

Introduced in 1996, the Code of Conduct is meant to ensure the highest level of integrity and corporate ethics by serving as a reference for all associates and partners in the different interactions involving their activities, as well as internal and external relationships. It was last updated in December 2014. In this 3rd edition, the following items were included: (i) the introduction of the Integrity Channel to report behaviors in conflict with the Code; (ii) the creation of the Integrity and Compliance Committee; (iii) anti-corruption rules; (iv) the inclusion of digital conduct and (v) the obligation for all Group associates to sign the Instrument of Commitment to the Code (learn more in the Compliance section).